IPST Single Sign On (SSO)

ระบบยืนยันตัวตนของผู้เข้าเรียนด้วยมาตรฐานการใช้งาน SSO (Single Sign On)

บริการติดตั้งระบบ บนเครื่องแม่ข่ายที่หน่วยงานของลูกค้า และเครื่องแม่ข่ายบนคลาวด์ ทั้งภายในประเทศและต่างประเทศ

บริการให้คำปรึกษาและปรับแต่งระบบ ที่ตรงตามความต้องการของลูกค้า ได้มาตรฐาน และสะดวกต่อการใช้งาน

บริการเชื่อมต่อระบบเข้ากับระบบงานหลักขององค์กร เพื่อให้กระบวนการทำงานดำเนินไปอย่างลื่นไหล เป็นระบบ อย่างมีประสิทธิภาพ

ศึกษา วิจัย วิเคราะห์ ออกแบบ และพัฒนาระบบ ที่สามารถตอบสนองผู้ใช้ โดยคำนึงถึงมาตรฐานและการเชื่อมโยงข้อมูลเป็นหลัก

ดูแลและให้คำปรึกษากับผู้ใช้งานตลอดเวลาทำการ เพื่อให้การทำงานของหน่วยงานหรือองค์กรมีความคล่องตัว ไร้ความกังวล

บริการแพลตฟอร์มและซอฟต์แวร์บนระบบคลาวด์ พร้อมการบริหารจัดการระบบและสำรองข้อมูลแบบครบวงจร

ระบบยืนยันตัวตนของผู้เข้าเรียนด้วยมาตรฐานการใช้งาน SSO (Single Sign On)

ระบบที่เชื่อมโยงข้อมูลผู้เรียนเข้าด้วยกัน มีการระบุตัวตนและระบบรักษาความปลอดภัยข้อมูลผู้เรียน สนั

ระบบห้องสมุดอัตโนมัติ สำนักงานนโยบายและแผนทรัพยากรธรรมชาติและสิ่งแวดล้อม (ONEP Library System) เป

A digital repository which preserves and distributes AU's publications, including papers, scholar

ระบบรวบรวมทรัพยากรดิจิทัลด้านพิพิธภัณฑ์วิทยา โบราณคดี ประวัติศาสตร์ และศาสตร์ที่เกี่ยวข้อง

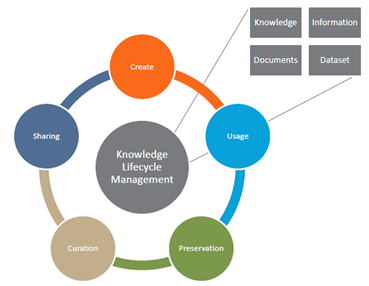

เราเชื่อมั่นในการแบ่งปันความรู้ และมุ่งมั่นในการสร้างวัฒนธรรมแห่งการแบ่งปันให้เกิดขึ้นในสังคม เราจึงตั้งใจดำเนินธุรกิจเพื่อส่งเสริมการจัดเก็บ การเข้าถึง และการกระจายความรู้อย่างเป็นระบบบนพื้นฐานของการประยุกต์ใช้มาตรฐานสากล เพื่อให้เกิดประโยชน์สูงสุดต่อการเข้าถึง เผยแพร่ และต่อยอดความรู้ในชุมชนและสังคม

เราพยายามดำเนินธุรกิจตามคุณลักษณะของผู้ประกอบการที่ดี 10 ประการ ได้แก่ 1. มีคุณธรรม 2. มีวิสัยทัศน์ 3. มีความเชื่อมั่น 4. มีความมุ่งมั่นตั้งใจ 5. มีวินัยในตัวเอง 6. มีความขยันขันแข็ง 7. มีความซื่อสัตย์ 8. มีความรับผิดชอบ 9. มีความอดทน และ 10. มีน้ำใจต่อผู้อื่น

เป้าหมาย

เราต้องการเป็นส่วนหนึ่งของการพัฒนาการเรียนรู้ตลอดชีวิตของคนไทย ดังพระราชดำรัสของพระบาทสมเด็จพระเจ้าอยู่หัวรัชกาลที่ ๙ เมื่อวันที่ ๔ ธันวาคม ๒๕๔๑ ว่า “เราไม่ควรให้ปลาแก่เขา แต่ควรจะให้เบ็ดตกปลาและสอนให้รู้จักวิธีตกปลาจะดีกว่า”

พันธกิจ

บริษัท ปันสาร เอเชีย จำกัด

131 อุทยานวิทยาศาสตร์ประเทศไทย (อาคาร INC 1 ชั้น 2 ห้อง 225)

ถ. พหลโยธิน ต. คลองหนึ่ง อ. คลองหลวง จ. ปทุมธานี 12120

02-564-7702